Dr Conor O’Kane writes for The Conversation about the impact of Friedrich von Hayek’s book 80 years after its publication…

Hayek’s Road to Serfdom at 80: what critics get wrong about the Austrian economist

Conor O’Kane, Bournemouth University

“The most powerful critique of socialist planning and the socialist state”, is how Margaret Thatcher described Friedrich von Hayek’s book, The Road to Serfdom. Published in March 1944 during the Austrian economist’s tenure at the London School of Economics (LSE), the book has been enduringly popular among free-market liberals.

Among its admirers was Winston Churchill, who as prime minister released 1.6 tons of precious war-rationed British government paper to allow additional copies to be printed. More recently Elon Musk tweeted a photo of The Road to Serfdom with the caption “Great Book by Hayek” to his 174 million followers, no doubt bringing Hayek’s work to a new generation.

On the other hand, the Austrian is often seen by the left as an intellectual bogeyman, an enabler of unfettered greed, minimal social responsibility and soaring inequality.

So who was Hayek and why does The Road to Serfdom matter?

How laissez-faire fell out of favour

Born into an upper middle-class Vienna family in 1899, Hayek earned doctorates in law (1921) and political science (1923) at the city’s university. He first made a name for himself in economics in 1928, publishing a report for his research institute employer that predicted the Wall Street crash of 1929 (some critics argue that his achievement gets exaggerated).

Hayek spent 18 years at the LSE (1932-1950), before moving to the University of Chicago (1950-1962). There he worked alongside Milton Friedman, another seminal advocate for free-market principles.

These views were profoundly unfashionable at the time. The social democrat consensus had been shaped by the “robber barron” period of the late 19th and early 20th centuries. Key industries such as rail and oil had been dominated by cartels and monopolies, leading to massive wealth inequalities.

Then came the Wall Street crash and great depression, prompting a loss of confidence in economists and economic reasoning. Free-market capitalism took much of the blame. Socialism was offered as a realistic and even desirable alternative.

Prominent colleagues of Hayek’s at the LSE, including political scientist Harold Laski and sociologist Karl Mannheim, believed socialist planning was inevitable in the UK. The Labour party explicitly warned in a 1942 pamphlet against a “return to the unplanned competitive world of the inter-war years, in which a privileged few were maintained at the expense of the common good”.

Hayek disagreed. He thought this wave of popular “collectivism” would lead to a repressive regime akin to Nazi Germany.

In The Road to Serfdom, he accepted the need to move beyond the laissez-faire approach of classical economics. But he argued in favour of “planning for competition” rather than the socialists’ “planning against competition” approach. He opposed the state being the sole provider of goods and services, but did think it had a role in facilitating a competitive environment.

In a central theme of the book, Hayek described the difficulties that democratic decision-making would face under central planning. He believed it would lead to policy gridlock and present opportunities for unscrupulous characters to become the key decision-makers.

Hayek’s goal was to show that the British intelligentsia was getting it wrong. Socialist planning, he believed, would see citizens returned to the types of limited freedoms endured by serfs under feudalism.

Hayek and conservatism

The Road was especially popular in the US. This was helped by Reader’s Digest publishing a shortened edition in 1945, introducing Hayek to a non-academic audience of some 9 million households. He was seized upon by conservatives opposing Franklin D Roosevelt’s interventionist New Deal, who feared for the loss of personal freedoms and a drift to totalitarianism.

However, Hayek was concerned his ideas had been oversimplified and misinterpreted. He warned of “the very dangerous tendency of using the term ‘socialism’ for almost any kind of state which you think is silly or you do not like”. By the mid-1950s he had distanced himself from American and European conservatives.

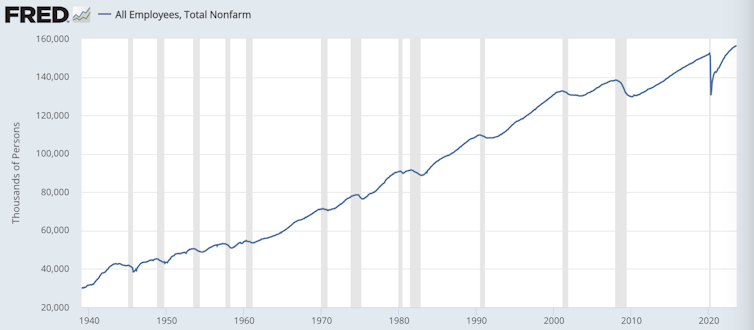

Ultimately, though, after the second world war most western countries adopted a more Keynesian approach. Named after Hayek’s greatest intellectual rival, John Maynard Keynes, this involved using government spending to influence things like employment and economic growth.

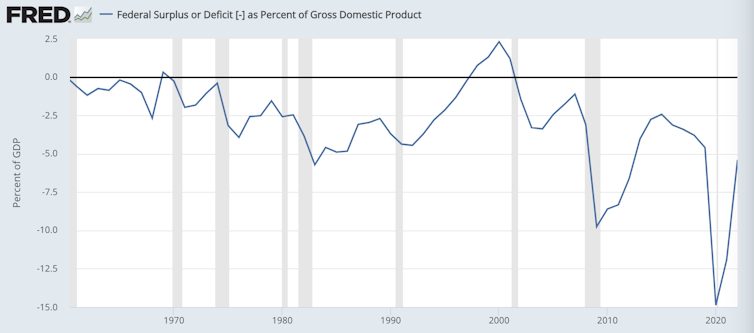

Hayek’s work, meanwhile, was mostly ignored until the 1970s, a period during which the UK became mired in stagflation and industrial action. He then became the inspiration for Margaret Thatcher’s policy mix of deregulation, privatisation, lower taxes and a bonfire on state controls of the economy. With the US also facing domestic economic challenges, the then US president, Ronald Reagan, followed suit.

What the critics say

If that was perhaps peak Hayek, he has been heavily criticised from some quarters in recent years. The American economist John Komlos, in his 2016 paper, Another Road to Serfdom, convincingly argues:

Hayek failed to see that any concentration of power is a threat to freedom. The free market that he advocated enabled the concentration of power in the hands of a powerful elite.

Such over-concentration had created the “too big to fail” environment in the financial sector in the run-up the global financial crisis of 2008, and many thought Hayekian deregulation was the culprit.

More recently, the tax-cutting economic policies during Liz Truss’s short stint as UK prime minister were incubated by think tanks who regard themselves as the keepers of the Hayekian flame. Similarly, Argentinian president Javier Milei’s libertarian vision of a minimalist state is said to be influenced by Hayek.

Equally, however, it is easy to fall into that trap of oversimplifying Hayek. It is worth noting, for instance, that in the Road, he also envisaged a substantial role for the state. He saw the state providing a basic minimum income for all. He also argued that “an extensive system of social services is fully compatible with the preservation of competition”.

Even Keynes congratulated him on his publication, saying, “morally and philosophically I find myself in agreement with virtually the whole of it”.

In short, while it’s probably fair to say that the world has had to suffer the flaws in Hayek’s ideas, it is important to separate him from his supporters. He was certainly no statist, but his vision for how best to run an economy was not as uncompromising as many would have us believe.![]()

Conor O’Kane, Senior Lecturer in Economics, Bournemouth University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Dr. Ashraf cited on ‘Modest Fashion’ in The Guardian

Dr. Ashraf cited on ‘Modest Fashion’ in The Guardian NIHR-funded research launches website

NIHR-funded research launches website Academics write for newspaper in Nepal

Academics write for newspaper in Nepal New paper published on disability in women & girls

New paper published on disability in women & girls Global Consortium for Public Health Research 2025

Global Consortium for Public Health Research 2025 MSCA Postdoctoral Fellowships 2025 Call

MSCA Postdoctoral Fellowships 2025 Call ERC Advanced Grant 2025 Webinar

ERC Advanced Grant 2025 Webinar Horizon Europe Work Programme 2025 Published

Horizon Europe Work Programme 2025 Published Horizon Europe 2025 Work Programme pre-Published

Horizon Europe 2025 Work Programme pre-Published Update on UKRO services

Update on UKRO services European research project exploring use of ‘virtual twins’ to better manage metabolic associated fatty liver disease

European research project exploring use of ‘virtual twins’ to better manage metabolic associated fatty liver disease