Why is ‘growth’ magical, mysterious and elusive in Eastern Europe, throughout most of Europe, in the spotlight as the recent buzz word. It is even more critical to those governments in debt or deficit crisis now? How do some economies have it and others not? Especially since 2008/9 GFC (Global Finance Crisis)? Without growth, it impacts on economies. Its effects are slow growth, stagnation, lower standards of living experiences, overcrowding, emerging diseases, competition over scarce resources, ultimately emerging into protest riots, conflicts even wars.

Who creates critical growth? Answer is the 90% of businesses in Eastern Europe, which are the fastest growing SMEs (small medium enterprises) including innovative manufacturing processes and complex value chains. It is businesses SMEs, which are thought to be critical to research 2024 and beyond – the top theme after the biggest health (though is mainly tangible ROI devices diagnostic tests equipment advances) and greater than innovation and tech, as ranked in the UK 2024.

Informal relationships and collaborative alliances are now viewed as growing importance as subfactor determinants alongside main indicators to attain growth. Moreover seemingly innocent barriers inhibitors to growth – relating to top agendas of governments like financial constraints and bribery incidence (corruption) – are speculated by my study to flatten recent past productivity outcomes in stress times.

So, does one of the keys to the conundrum of productivity, my study proposes lie in removing barriers, so creating freedoms to growth prosperity sustainability and business transformation? Is it by uncovering what is hidden within and possible to achieve, as opposed to injecting new resources services or aid either monetary or non-monetary which reduce ROI (return on investment made) which assisted in the past? Is this the lesson of Eastern Europe for the West, which is growing faster albeit off a slightly smaller baseline total than most of the top of the G7. However, perceptions need testing with empirical evidence where none or little exists – so these are the themes of this British author and her own research at Bournemouth University.

This leads to the implications of how do you create successful models for growth adaptations relevant to the 2020s and Eastern Europe, another theme of resurging interest in the 2020s, for example EACES 2024, a keynote programme theme by a leading light, Post-Keynesian Economics, Professor Stockhammer (King’s College, London)? The Eastern front is protecting us, for this is unheard for Europe since zeitenwende 24022022, where Kyiv reminds me of cultured Vienna. Whereas other parts of the world outside Europe continent, it is a different scenario, it does not change, it is the norm and have always been at barbaric medieval war continuously flaring with low rights freedoms, long before I was born.

If you think your working and personal life is tough going count yourself lucky:

i) Professor Kyiv School Of Economics says to me (BU) online IZA seminar (in a break from drones overhead in a skeletal department) he knew the Durrells of Bournemouth. [Note: Famous Gerald Durrell linked to famed family with Margo’s Durrell Boarding House of Bournemouth (in fact, Gerry’s collection of animals were initially housed in back garden garage before new premises), a feature film 2019].

ii) SME mainly female businesses work in Kyiv, Ukraine (all partners men 25-59 age bar minimum essential are conscripted mandatory onto the front lines.

iii) 08072024 41 killed as Russian Missile hit children maternity hospital Kyiv, Ukraine

iv) SME sanity she escapes Kyiv shelling work/home to Ukraine’s beautiful mountains.

Sources: copyright my own/donated freely sent to me – ‘Everyday Academic and SME business life in Eastern Europe’ on our Eastern Frontier 2022-2024 – Lest anyone forget what is protecting our own peace and way of life here.

Alternatively, a further complex conundrum exists where the economy may have possibly continued to generate income all along, with inequalities of wealth growth evident or disappearing abroad or into offshore havens, so it does not grow the host economy and is not traceable non-productive, so not providing surpluses for developing society, even drains resources in an increasing debt ratio as it draws but does not give back, so is hidden invisible. It could also even be part of a growing ‘shadow economy’ (outside personal scope due to income below legally tax thresholds or creative tax accounting to pay less taxes and other avenues, but it is a growing interest theme researched by another at AFE, BUBS, Bournemouth University).

What does it look like this growth? Government budgets and announcements in Europe currently revolve around it. So, what? READ ON IF WISH TO FIND OUT AND A LITTLE OF MY STUDY FINDINGS IN DEVELOPMENT – IF NOT THANK YOU FOR READING THIS EYE OPENING OVERVIEW WHERE EAST MEETS WEST, AND WEST GETS AN AWAKENING AS MEETS EAST.

So, as an example of the past decade 2008/9 to 2019 post GFC (Global Financial Crisis) from Eastern Europe, my own research study data. It reveals how in the past decade that economic growth has become more complex and no longer necessarily is related directly as before to productivity growth. So, I am finding that potentially being more productive is not necessarily the answer to ultimate economic growth anymore but increasing it could be one factor determinant towards boosting overall growth in the economy – which needs financial surpluses not debt and clean scores not corruption to thrive. Furthermore, my study provides evidence for heterogenous (diverse) different productivity outcomes related to financial constraints and bribery corruption across Eastern Europe compared to more accepted homogenous (similar) flattening productivity trends in ‘the West.’

The Productivity Gap = hierarchy economic states for top 30% and bottom 30% in my study findings 2019 and 2008/9 of 27 transition economies Eastern Europe

smaller gap 2008/9 to 2019 shows productivity growth%

has slowed down the most in higher productivity economies of study SME firms

top8 30% total sample gap [log] 0.42

bottom8 30% total sample gap [log] 1.23

Source: Author own construct

The Productivity Gap = hierarchy economic states for top 30% and bottom 30% in my study findings 2019 and 2008/9

Typical Most prominent

Top 8 group

30% total samples firm-level study largest yet slowest growing Productivity

2008/9 and 2019 (not in precise order as changes over decade)

Czech Slovenia Lithuania Poland Latvia Estonia Hungary Slovak rep

Typical Most prominent Bottom 8 group 30% total samples firm-level study smaller yet fastest growing Productivity

2008/9 and 2019 (not in precise order as changes over decade)

Azerbaijan Ukraine Armenia Georgia Kosovo Uzbekistan Kyrgyz rep Tajikistan

Source: Author own construct

*Although at a lower starting point, the bottom third hierarchy of economies in my study, the third decade of independence in Eastern Europe where there is a gap as relatively no extensive large cross countries evidence exists, before the turning point of 2019, findings are it has grown faster and seen far less flattening in productivity than the top third economies, suggesting something different is happening here between Northern and Southern economies in Eastern Europe (ECA borders) especially.

So, the implications could be that these are the economies with growing economies that investors are attracted towards either i) the top most productive with least corruption most stability or ii) despite lower baseline are fastest growing for greatest yields, so achieving a real return on investment (ROI) when offering FDI (foreign direct investment). However, the top performers are flattening or the most attractive performers have higher risk impacted upon by geopolitical geo-economic volatility, conflict, geopolitical instability and corruption, so delaying foreign investments made which impacts hardest upon Eastern Europe that depends more on FDI more so than ‘the West.’

Eastern Europe matters most to us in Britain too, not just Eastern Europe itself, this is because Europe is pragmatically our geographically closest advanced protective neighbour with cost-effective tangible benefits and historic long-term finance economic alliances. Research reports in 2024 shows Eastern Europe gains spill-overs by closely collaborating trading on its own borders with its neighbours. Also, advantages are closest geo-economic (geographical) alliances brings economies of scale savings. Further more as in 11092024 world news and UK reported too: “most proud of the unity, we and all our allies have shown in support for Ukraine,” furthermore “reiterating that Ukraine’s freedom is crucial for Europe” as well. For it holds up the Eastern front for European peace that includes financial economic order against destabilisation – in addition to the benefits of Europe retaining access to its vast required precious minerals especially lithium ions think mobile phones EV energy and vast food grains store which are recently providing sources of competitive conflict for scarce precious resources.

Critically, the whole of Europe itself should not be diminishing as seen in the 2020s but needs to stand up and increase now in its own continental priorities for survival and striving for growth. Like it did so before GFC (Global Financial Crisis) 2008 and before EU even existed pre1991 (for those who remember either born and travelling Europe/USA easily safely even when very young freely or perhaps working flying travelling before then too – so it can’t be blamed on recent Brexit 2020 although Brexit has left a quagmire legacy of increased technocrat, bureaucracy, restrictions, trading barriers and red tape attached still as not being in the EU unlike pre1991. But countries do survive without the EU, hence some of Eastern Europe’s cynicism.

The productivity growth trends can be seen in both my study tables 2008/9 to 2010 and following independent source tables 1997-2007 and 2008/9 to 2019:

Comparison OECD G7 (important contrast outside Eastern Europe study focus)

Since the 2008/9 economic downturn, growth rates have been slower in all G7 countries, with the UK and US having the largest slowdowns. Even closer to home, outside of my study scope, the UK’s productivity (outside of my study scope) has fallen away from most of the other G7 countries during this period, which corresponds to my Eastern European study’s turning point notion of 2019 being predictive of the 2020s and what lessons can be learnt.

It is interesting to look outside of my research scope in context briefly at the G7, the ‘so called advanced economies’ compared to the transition economies too who are rapidly catching up converging or a few top economies overlapping now too with the G7.

G7 Economies – Compound average annual growth rate of output per hour worked (a measure of productivity is output per worker too preferred by this researcher compared to total productivity factor measurement), before and after 2008/9 economic downturn due to GFC mainly.

Average annual growth (%) 1997 to 2007 (left)

Average annual growth (%) 2009 to 2019 (centre)

Difference (right)

US 2.3 0.8 -1.5

UK 1.9 0.7 -1.2

France 1.6 0.9 -0.7

Canada 1.5 1.0 -0.5

Japan 1.6 1.2 -0.4

Germany 1.4 1.1 -0.3

Italy 0.4 0.4 0.0

G7 mean 1.9 0.9 -1.0

Source: OECD data, Office for National Statistics calculations

Notes

1. The figures for the UK in this table differ slightly to ONS National Statistics estimates of output per hour worked.

2. Sources suggest that measurement units used may differ but produce similar trend lines.

3. Note: the homogenous similarities of growth too in G7 compared to heterogeneity of Eastern Europe.

To quote the past famous economists from Kings College, Cambridge with Keynes who was also a practitioner treasurer advisor to British Government too with relevance:

“Whether this account is true or fanciful, there can be no doubt as to the immense change in public sentiment over the past two years” (Keynes, 1919; 1931).

“But perhaps it is only possible in England to be so unconscious. In continental Europe the earth heaves. Not just about extravagance or “labour troubles”; but of life and death, of starvation and existence (‘including disease and poverty’), and of the fearful convulsions of a dying civilization” (Keynes, 1919). Analogous to productivity and today’s society environment.

“Ending up very soon facing a monumentally unjust inequality of income and wealth; a conflictual world with warring regions, religions and ethnic groups; a depleted, desertified [sic] and unviable planet, dominated by squalor, ignorance, want, idleness and disease.” (Nuti, 2018C, p. 15 Nuti 1937-2020). This is it in a nutshell, one hundred years later, as echoes Keynes in 2019. So, what lessons have we learnt is contentiously dubious debatable?

“Mario Nuti was a major theoretical and policy figure in economics; perhaps the last of the major UK post-Keynesians in a line of significant Cambridge economists. Notably – Mario questioned the success of the transition economies, terming it more as “a development into a ‘mutant’ economic system. “Due to “seismic faults” in the European Union – including Brexit, austerity policies, tiny EU budget, premature introduction of the Euro, migrations, tax competition, tolerance of illiberal regimes, divergence of welfare policies – its institutions and policies are equivalent to “tectonic plates sliding over each other and colliding” (Nuti, 2018b). Mario particularly condemned the persistence of austerity policies, demonstrating that fiscal consolidation can actually increase, instead of decreasing, public debt/GDP ratio.” (Estrin and Uvalic, 2020; 2021; 2022, 2023, 2024). Nuti and his thinking is a top appreciation theme of EACES (European Association of Comparative Economics Studies) 2024.

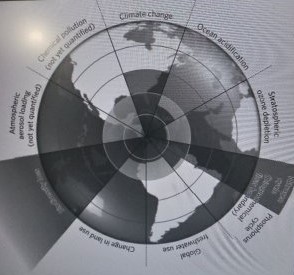

This adds weight to the imperative of this researcher in conducting further imperative finance economics research as part of the quest like a holy grail mission to contribute towards advancing knowledge required ultimately towards peace stabilisation, balanced not so volatile finance economics equilibrium required for international order, sustainability and growth for survival. So, ultimately to meet now an expanding ever demanding (beyond supplies is Keynesian) overpopulated world competing for resources on the planet in the so called ‘dependent advanced civilised society,’ unless one wishes to return to the alternative of literally the relative dark ages of existing simple indigenous independent self-sufficient people and roaming nomads on the planet. Therefore, the researcher’s contribution to the words of magical mysterious elusive ‘growth’ and the proposed subfactor of productivity outcomes.

To end on a lighter note and the takeaway mini-bite, especially for the non-finance economists (if mathematics, finance, economics, statistics and modelling blow your mind and goes over your head) then maybe you can relate all of this to extracted lines from a memorable theme song:

“Millenium” song by Robbie Williams:

We’ve got stars directing our fate (Millennium)

And we’re praying it’s not too late (Millennium)

Some say that we are players

Some say that we are pawns

But we’ve been makin’ (takin’) money

Since the day that we were born

Cos we’re low down (low down)

Run around in circles

Then we’ll slow down (Slow down)

Before we fall down

We all enjoy the madness

Cos we know we’re gonna fade away

(And we won’t stop)

Songwriters: Robert Peter Williams, John Barry, Leslie Bricusse, Guy Antony Chambers.

For the optimists there is the movies like ‘Sliding Doors’ with its two parallel universes (an increasingly popular concept), one golden returning progressing ‘happy places making beautiful memories’ outcomes is “the new trend now” and one universe the dark side black hole which is very volatile dark just like financial economic pain society disorder. Or the iconic star trek movie, where Spock the Vulcan from another planet, replies to the captain of the starship enterprise on charting a new course forward, ‘there is life, but not as we know it.’

Mario Nuti (Cambridge economist, researcher, opinion leader) once wrote: ‘I used to reproach myself for not doing enough work, for I only regarded research as true work, but now I regret not having spent more time on a beach’ (Nuti, 1992a). Indeed, wherever he was, Mario was always surrounded in solitude by books, papers, notes, and he never stopped working (on his research matters), up to his very last days.” Likewise, Bournemouth and Dorset offers great opportunities for combining its microclimate with amazing beaches, ideal for reflective higher thinking alongside its dedicated research and publication offerings.

So ideally realistically, the best research it is intrinsically driven (not extrinsic) with passion dedicated determination as when ‘the going gets tough only the tough get going’ (theme song film used in USA business),’ so always like an ongoing daily mission to climb a mountain expedition to its peak and ongoing beyond this, only for critical subjects in demand that create a real difference impact relevant in 2024 and onwards, for a significant number in the real world on local, national, international levels (not peripheral often loud background noise minorities), which only then has long been proven to deliver ££££’s benefit contribution for every £1 invested in research (Return on Investment) back to the UK society, planet and the economy (to add growth to the source investment resources made) otherwise it dissipates disappears, destroying ‘the goose that laid the golden eggs (fable and often USA business expression).

In line with this, all eyes are upon trend setting, Canadian PM, Trudeau, September, 2024 is looking for a critical significant contribution to strengthening the economy, its priorities, its workforce to even include advanced research in education to protect the integrity of the system itself and dramatically already reducing transient permits (including spouses)’ where specifically “changes are part of a larger effort to ensure a well-regulated and sustainable system.” “Not everyone who wishes to come to Canada will be granted entry, and not everyone currently residing here will be able to remain indefinitely. It is our duty to safeguard the integrity of our policies, and we are committed to adapting them to meet today’s evolving challenges,” he and his minister told Business Insider.’ This will achieve sustainability and ultimately strive for the government priorities of growth.

Source: Just Breathe

My current research life journey truly looks like this as reach a top peak phase

(those who truly know it is as is for themselves too as growth is internal and external)

Thank you, this is a longer blog essay account on the current topical buzz word of ‘growth,’ because finance economics articles often take longer to publish in AFE subjects, so are rarer in BU than some prolific publishing disciplines with shorter time frames more publications – as we all await the research contributions to be made, in the next insightful cluster of awaited exciting future pipeline research publications and creative media outputs by the BUBS and AFE (accounting, finance and economics) 2024 even 2025 as well as ideally by myself too makes a welcomed contribution then too.

Disclaimer: The themes are of top current relevance, but independent viewpoints not necessarily reflecting others connected with Bournemouth University. Notably, “Economist Keynes later admitted after 2019 the ‘consequences of the peace’ in reflection that his (words) prophecies were far more successful than his persuasion influence.”

Fiona ‘Stewart’ Vidler

MBA MSc MLIBF

Former MIPR (media) and Financial Advisor, Decision-Making Strategy (Corporate and SME) Director roles – Financial Times Business Winner (media ROI winning difference)

Corruption and Financial Constraints Impacts upon SME Firm Productivity – European Transition Economies in Crisis

(Finance Economics Advanced Researcher –research annual review rated ‘Excellent’ 2024)

Bournemouth University Business School (BUBS) – ‘Catalyst for Growth Fusion’ 2022-26.’

Previously British Senior Researcher (over a decade/s experience): RHUL, Defra (as prior MAFF), DSTL (as prior MOD), International Crisis Management Researcher (Burson-Marsteller A-team) and Director Education/ Marketing/ Research /Media /Conference /Round-table programs for professors leading lights networks creation and bidding team budgets writing programs £10K to £3M

‘

Expand Your Impact: Collaboration and Networking Workshops for Researchers

Expand Your Impact: Collaboration and Networking Workshops for Researchers Visiting Prof. Sujan Marahatta presenting at BU

Visiting Prof. Sujan Marahatta presenting at BU 3C Event: Research Culture, Community & Can you Guess Who? Thursday 26 March 1-2pm

3C Event: Research Culture, Community & Can you Guess Who? Thursday 26 March 1-2pm UKCGE Recognised Research Supervision Programme: Deadline Approaching

UKCGE Recognised Research Supervision Programme: Deadline Approaching ECR Funding Open Call: Research Culture & Community Grant – Apply now

ECR Funding Open Call: Research Culture & Community Grant – Apply now ECR Funding Open Call: Research Culture & Community Grant – Application Deadline Friday 12 December

ECR Funding Open Call: Research Culture & Community Grant – Application Deadline Friday 12 December MSCA Postdoctoral Fellowships 2025 Call

MSCA Postdoctoral Fellowships 2025 Call ERC Advanced Grant 2025 Webinar

ERC Advanced Grant 2025 Webinar Update on UKRO services

Update on UKRO services European research project exploring use of ‘virtual twins’ to better manage metabolic associated fatty liver disease

European research project exploring use of ‘virtual twins’ to better manage metabolic associated fatty liver disease