‘Globalisation, integration, cooperation – what is at stake in the current turbulent times? The title of the 6th Conference in cooperation with the European Association for Comparative Economic Studies 22-23 March 2024 hosted in South-East Europe, Szeged University.’ An EACES member from Bournemouth University, joined in via the host hybrid liaison of an ‘economic constraints online’ distance free option in parts recorded. This conference was a cauldron of many research talks, many directly from SE Europe – within ‘geo-economic fragmenting’ (EACES terminology), presenting multi-factorial pathways for alternative futures.

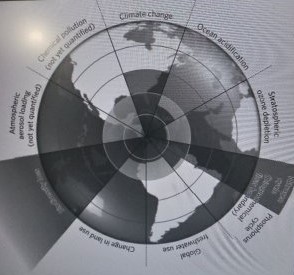

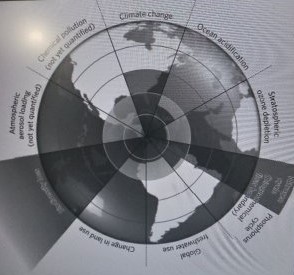

The conference keynote plenary presentations were by leading European research institutes: Marzenna Anna Weresa, Professor of Economics (Warsaw School of Economics): European Competitiveness in Turbulent Times: Focus on Innovation. Nicolaas Stijn Groenendijk, Professor of Public Policy, Organisation and Innovation (Inland Norway University of Applied Sciences): Global resources and the EU’s strategic autonomy role (EU, he stated is small relating to global spaces which should be protected not controlled: satellites, security economics, governance and environment including outer space, cyberspace, weapons, instruments in interplay with geo-economics geopolitics).”

Professor Weresa, Poland, emphasised the importance of using “innovative competitiveness to survive turbulence changing behaviours, attitudes, experimenting” with the “ability to improve productivity through use of relational capital, resources; ability to create evolving new relationships (collaborations, alliances) in providing a stable framework for multidimensional co-operation in arenas of social, ecological, economic, that must ultimately lead to sustainability, building human and social capital to transform labour market and environment with need of competitiveness support from new policies to meet the challenges in 20th anniversary year of EU integration in this zone.”

FOR INTRIGUED READERS, MORE RARE INSIGHTS: Demands for extra finance economic investment were identified by some presenters as divided into a ‘never-ending goal of closer convergence by the most advanced Eastern European transition economies, or deterioration even instability has occurred’ (where constrained not received). Alongside improving financial models, financial digitalisation and green transition research, where ‘large investment is needed mainly for SMEs’ (small medium enterprises are the majority of firms in Eastern Europe). Alternatives to beneficial FDI (foreign direct investment) were highlighted, with some potential FDI kept for ‘national home issues’ by others, alternatively benefits of keeping ‘productivity and trading boundaries’ closer together within Eastern Europe. Research into ‘Roundtripping FDI,’ academically ‘defined as onshore corruption and offshore secrecy for starting-up businesses or mitigating figures is reports progress for this complex to measure indirect FDI, transmission shipment via a hidden host intermediary economy. Reality challenges stated in geo-economics and geo-policies to achieving either ‘strength’ from co-operation, integration and finance economic strategies within more heterogeneity (differences) and increasing ‘potential vulnerability’ from dissipation, stasis, fragmenting debated. One South-East Europe researcher described ‘as wishing to help the EU as currently it is like a parent struggling not coping very well in relation to Eastern Europe matters.’ A new finance economic societal era change called ‘Zeitenwende’ is gaining momentum in academia and popular media.

NOTE: Professor Michael Landsmann, The Vienna Institute, REGRETTED BEING UNABLE TO VISIT AND LEAD OPEN THE CONFERENCE KEYNOTE DUE TO LAST MINUTE CIRCUMSTANCES BUT HIS RESEARCH CONTRIBUTION IN THIS ARENA IS: ‘importance of understanding economics from a global perspective and multiple view-points.’ Coincidentally, the previous week, the UK defence secretary returned from a visit to Ukraine and Poland NATO exercises, with a satellite signal jamming of his plane’s navigation system, near Kaliningrad; stressing “increased 3% GDP spend on defence” and “support for Ukraine,” according to the Times, “it was a wake-up call,” as he saw a different ‘East-West’ in engagement mode perspectives instead of ‘West-East.’

Notably, Michael Landsmann co-authored ‘Russia’s invasion of Ukraine: assessment of the humanitarian, economic, and financial impact in the short and medium term’ in International Economics and is ‘the Economist winner of the Rothschild Prize 2022’. Michael Landsmann published research states: ‘how can the geo-economic and geopolitical challenges of our time be classified and understood, and how is the West and East integration proceeding?’ “Economic policy issues are not purely factual questions, but involve – as Kurt Rothschild emphasised” – “questions of power, interests and the goals of various social groups”. ‘With his analytical approach, Michael Landesmann has made these power constellations, interests and goals visible. In his lectures, he concretises this approach using three developments: Russia’s war against Ukraine, energy and inflation crisis, and global multipolarity. He relates it to the title of his lectures revolving around conceptual ‘centrifugal and centripetal forces in the European integration process,’ and ‘the need for flexible and experimental economic policy in turbulent times.’

BU: An independent report on topical critical latest Eastern European Matters in research by Fiona Vidler MBA MSc MLIBF, member of EACES, with BUBS AFE quantitative research theme: Impacts of Corruption, Financial Constraint and Firm Productivity. Global Crisis Times – SME Evidence from European Transitional Economies – historical roots in comparative economics past hundred years: focus on over thirty years ago, fall of the Berlin Wall (1989) and Independence (1991), with empirical regression analyses interpretations (using prior advanced statistics econometrics research training by USA specialists) in global financial crisis turbulence timeframes for SMEs (small medium enterprise) firms; exploring economic trading alliance influences relationships; endogenous (internal causes) effects beyond exogenous crises (a resurgence interest in visionary post-Keynesian on economic consequences from the 1930s, elements now reoccurring).

(PDF) Poster 2023 Fiona Vidler AFE BUBS (researchgate.net)

BU attendance at third annual GCPHR meeting in June

BU attendance at third annual GCPHR meeting in June Interactive Tangible and Intangible Heritage Applications – BU student work featured in new book chapter

Interactive Tangible and Intangible Heritage Applications – BU student work featured in new book chapter Second NIHR MIHERC meeting in Bournemouth this week

Second NIHR MIHERC meeting in Bournemouth this week MSCA Postdoctoral Fellowships 2025 Call

MSCA Postdoctoral Fellowships 2025 Call ERC Advanced Grant 2025 Webinar

ERC Advanced Grant 2025 Webinar Horizon Europe Work Programme 2025 Published

Horizon Europe Work Programme 2025 Published Horizon Europe 2025 Work Programme pre-Published

Horizon Europe 2025 Work Programme pre-Published Update on UKRO services

Update on UKRO services European research project exploring use of ‘virtual twins’ to better manage metabolic associated fatty liver disease

European research project exploring use of ‘virtual twins’ to better manage metabolic associated fatty liver disease